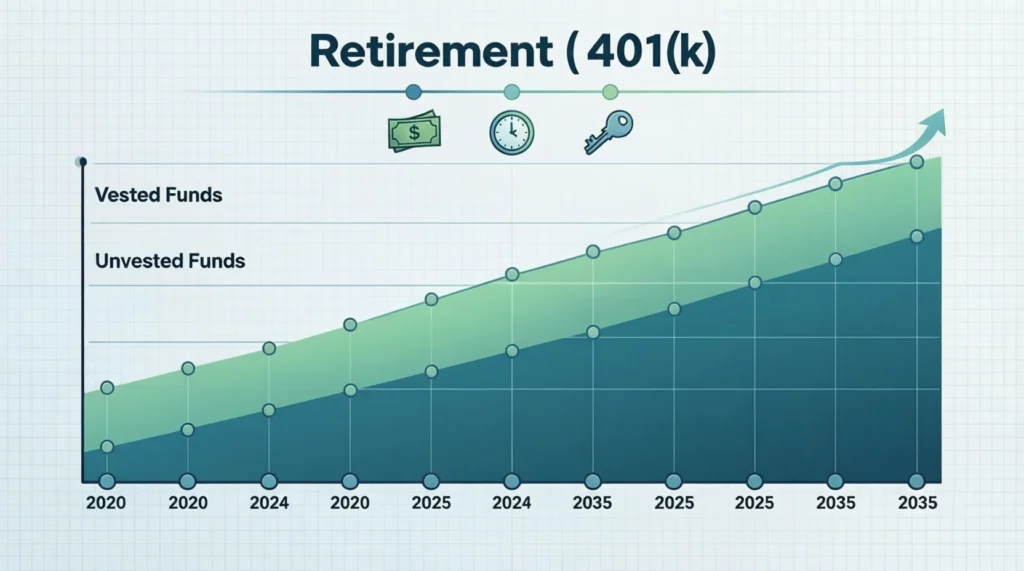

In a 401(k), “vested” means the portion of your retirement account that you legally own and can keep, even if you leave your job. Your own contributions are always 100% vested, while employer contributions may vest over time based on your company’s vesting schedul

Imagine checking your 401(k) balance and feeling proud of the number only to learn that not all of it is actually yours yet. 😬 That’s where the concept of vesting comes in. It’s one of the most misunderstood yet most important terms in workplace retirement plans.

Whether you’re changing jobs, negotiating an offer, or planning long-term retirement goals, understanding what vested means in a 401(k) can save you thousands of dollars and a lot of stress. This guide breaks it all down in plain English, with real-world examples, tables, comparisons, and practical tips you can actually use.

What Does “Vested” Mean in a 401(k)?

In the context of a 401(k):

- Vested = money that belongs to you permanently

- You keep it even if you quit, get laid off, or retire

- Vesting usually applies only to employer contributions, not your own

The Two Main Sources of 401(k) Money

- Employee contributions (your money)

- Always 100% vested immediately

- Employer contributions (matches or profit sharing)

- May vest over time, depending on plan rules

If you leave your job before becoming fully vested, you may forfeit part or all of your employer’s contributions.

Why Vesting Exists in 401(k) Plans

Vesting isn’t random—it serves a purpose.

Why Employers Use Vesting Schedules

- Encourage employee retention

- Reward long-term commitment

- Control benefit costs

- Align retirement benefits with company tenure

From an employer’s perspective, vesting helps keep talented employees around. From an employee’s perspective, it’s an incentive—and sometimes a trap if misunderstood.

Origin and Evolution of Vesting in Retirement Plans

The idea of vesting comes from traditional pension plans, long before 401(k)s existed.

A Brief History

- 1974 – ERISA (Employee Retirement Income Security Act)

Established federal rules for retirement plans, including vesting protections. - 1980s – Rise of 401(k) plans

Vesting rules were adapted for employer contributions. - Today

Vesting schedules are regulated but still flexible within IRS limits.

Thanks to ERISA, employers cannot make vesting schedules unlimited or unfair.

How Vesting Works in a 401(k): The Basics

Vesting is typically based on years of service.

Common Vesting Schedules

1. Immediate Vesting

- 100% vested right away

- Rare but very employee-friendly

2. Cliff Vesting

- 0% vested until a specific year

- Then suddenly 100% vested

3. Graded Vesting

- Gradual increase over time

- You earn ownership in stages

Example Table: 401(k) Vesting Schedules Explained

Example: $10,000 in Employer Contributions

| Year of Service | Graded Vesting % | Amount You Keep | Cliff Vesting % | Amount You Keep |

|---|---|---|---|---|

| 1 year | 20% | $2,000 | 0% | $0 |

| 2 years | 40% | $4,000 | 0% | $0 |

| 3 years | 60% | $6,000 | 0% | $0 |

| 4 years | 80% | $8,000 | 0% | $0 |

| 5 years | 100% | $10,000 | 100% | $10,000 |

📌 Key takeaway: Leaving even a few months early can cost you real money.

Real-World Usage: How People Talk About “Vested”

You’ll hear “vested” used in different tones depending on the situation.

Friendly / Informative Tone

I’m fully vested next year, so I’m definitely staying until then 😊

Neutral / Professional Tone

According to the plan document, employer contributions vest after four years of service.

Frustrated or Negative Tone

I left too early and lost my employer match because I wasn’t vested yet 😤

In everyday workplace conversations, “vested” often signals timing, loyalty, or financial strategy.

What Happens to Your 401(k) When You Leave a Job?

This is where vesting really matters.

If You Leave Your Job

You keep:

- ✅ 100% of your contributions

- ✅ 100% of vested employer contributions

You lose:

- ❌ Any unvested employer contributions

After Leaving, You Can:

- Leave the money in your old employer’s plan

- Roll it over into a new 401(k)

- Roll it into an IRA

- Cash it out (not recommended due to taxes and penalties)

Vested vs. Unvested: What’s the Difference?

| Term | Meaning |

|---|---|

| Vested | Money you fully own |

| Unvested | Employer money you may lose if you leave |

| Fully vested | You own 100% of all contributions |

| Partially vested | You own some, but not all, employer contributions |

Understanding this difference is crucial when evaluating job offers or exit timing.

Vested Balance vs. Account Balance

Many people confuse these two.

- Account balance: Total money shown in your 401(k)

- Vested balance: Amount you can actually take with you

Always check your vested balance, especially before resigning.

Comparison: Vesting in 401(k) vs Other Retirement Plans

401(k) vs Pension Plans

| Feature | 401(k) | Pension |

|---|---|---|

| Employee contributions | Yes | Usually no |

| Employer contributions | Yes | Yes |

| Vesting applies | Employer portion | Entire benefit |

| Portability | High | Low |

401(k) vs IRA

- IRAs have no vesting

- All money in an IRA is always yours

- Vesting only applies to employer-sponsored plans

Common Myths About 401(k) Vesting

❌ Myth: My employer can take my vested money

✅ Fact: Once vested, it’s legally yours

❌ Myth: Vesting applies to my paycheck deductions

✅ Fact: Your own contributions are always vested

❌ Myth: Vesting resets if I get promoted

✅ Fact: Vesting is based on service time, not job title

Alternate Meanings of “Vested”

Outside retirement plans, “vested” can mean:

- Having a strong interest

Example: She has a vested interest in the project’s success. - Clothing-related (UK usage)

A vest = sleeveless garment

In finance and employment, though, vesting almost always refers to ownership rights over time.

Polite and Professional Alternatives to “Vested”

In formal documents or HR discussions, you might see:

- Earned

- Accrued

- Fully owned

- Non-forfeitable

- Secured benefits

These terms often appear in plan summaries or legal language.

How to Check Your Vesting Status

Here’s how to stay informed:

- Log into your 401(k) provider’s website

- Look for “Vested Balance” or “Employer Match Status”

- Review the Summary Plan Description (SPD)

- Ask HR directly (this is very normal!)

📌 Tip: Always confirm vesting before submitting a resignation.

Strategic Tips to Maximize Your Vested 401(k)

- Time job changes around vesting milestones

- Factor vesting into job offer comparisons

- Don’t ignore employer match—it’s free money

- Track vesting annually, not just when leaving

- Consider long-term value, not just salary

Sometimes staying a few extra months can mean thousands more for retirement.

Frequently Asked Questions (FAQ)

1. What does vested mean in a 401(k) in simple terms?

It means the money is officially yours to keep, even if you leave your job.

2. Are employee contributions always vested?

Yes. Your own paycheck contributions are 100% vested immediately.

3. How long does it take to become fully vested?

It depends on your employer’s vesting schedule—commonly 3 to 5 years.

4. What happens to unvested 401(k) money?

Unvested employer contributions are forfeited when you leave the company.

5. Can vesting schedules change?

They can change for future contributions, but usually not retroactively.

6. Is vesting the same as being eligible?

No. Eligibility means you can participate; vesting means you own the money.

7. Does vesting affect taxes?

No. Vesting affects ownership, not tax treatment.

8. How do I know if I’m fully vested?

Check your 401(k) account dashboard or your plan’s Summary Plan Description.

Conclusion:

Knowing what vested means in a 401(k) empowers you to make smarter career and financial decisions. Vesting determines what money you truly own, when you should consider changing jobs, and how valuable an employer’s match really is.

Justin Young is a passionate Digital Creator and Content Writer who specializes in crafting engaging, informative, and results-driven content. He focuses on creating high-quality, blog posts, and digital content that capture attention and deliver real value to readers. With a strong interest in storytelling, trends, and online growth, Justin helps brands and individuals connect with their audiences through clear, impactful, and creative writing.